Summer Corporation's business is international in scope and is subject to income taxes in several countries.Summer's earnings and income taxes paid in the relevant foreign countries are:

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: In May 2008, Cindy incurred qualifying rehabilitation

Q82: Rick spends $750,000 to build a qualified

Q87: Identify the statement below that is false.

A)If

Q89: Explain the purpose of the tax credit

Q92: During 2012, Eleanor earns $120,000 in wages

Q97: Discuss the treatment of unused general business

Q107: In May 2012,Blue Corporation hired Camilla,Jolene,and Tyrone,all

Q108: Bradley has two college-age children, Clint, a

Q109: Phil and Audrey, husband and wife, are

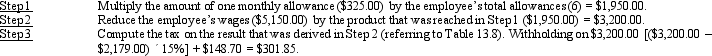

Q111: Ken is married to a nonemployed spouse

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents