Hugh has four passive activities which generate the following income and losses in the current year.

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

How much of the $80,000 net passive loss can Hugh deduct this year? Calculate the suspended losses (by activity).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Ken has a $40,000 loss from an

Q93: What special passive loss treatment is available

Q95: Marcia borrowed $110,000 to acquire a parcel

Q98: During the year, James performs the following

Q100: List the taxpayers that are subject to

Q103: When a taxpayer disposes of a passive

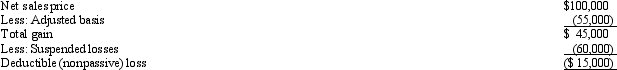

Q111: Pat sells a passive activity for $100,000

Q126: Identify the types of income that are

Q127: Describe the types of activities and taxpayers

Q130: Describe the general rules that limit the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents