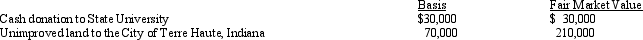

Paul,a calendar year married taxpayer,files a joint return for 2012.Information for 2012 includes the following:  Paul's allowable itemized deductions for 2012 are:

Paul's allowable itemized deductions for 2012 are:

A) $13,500.

B) $32,400.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Q81: Harry and Sally were divorced three years

Q82: Helen pays nursing home expenses of $3,000

Q83: Samuel, an individual who has been physically

Q91: Which of the following items would be

Q92: Charles,who is single,had AGI of $400,000 during

Q94: For calendar year 2012,Jon and Betty Hansen

Q96: In 2005, Ross, who is single, purchased

Q97: Pat died this year.Before she died, Pat

Q98: George is single,has AGI of $255,300,and incurs

Q105: The City of Ogden was devastated by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents