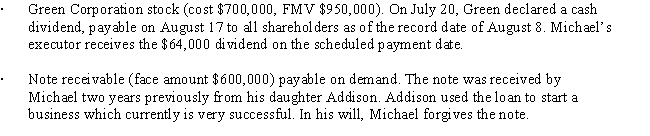

At the time of his death on August 7,Michael owned the following assets.

How much,as to these transactions,is included in Michael's gross estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Classify each of the following statements:

-Hector transfers

Q84: Match each statement with the correct choice.

Q97: Classify each of the following statements:

-Under her

Q112: Walt dies intestate (i.e., without a will)

Q114: At the time of her death on

Q116: Classify each statement appearing below.

a. No taxable

Q116: At the time of her death,Amber owns

Q118: At the time of her death,Sophia was

Q121: Lily pays for her grandson's college expenses.Under

Q124: Cole purchases land for $500,000 and transfers

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents