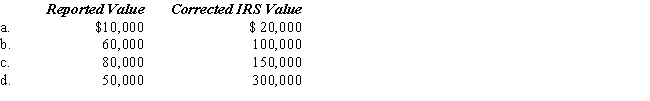

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal Federal estate tax rate of 40%.

Correct Answer:

Verified

Q111: The Treasury document regulating the professional conduct

Q126: A(n) $ penalty applies if the tax

Q129: A CPA, an attorney, and a(n)_ can

Q130: The tax preparer penalty for taking an

Q131: Silvio, a cash basis, calendar year taxpayer,

Q134: Quon filed his Federal income tax return

Q136: Compute the failure to pay and failure

Q139: A(n) _ member is required to follow

Q148: Maria did not pay her Federal income

Q154: Clarita underpaid her taxes by $50,000. Of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents