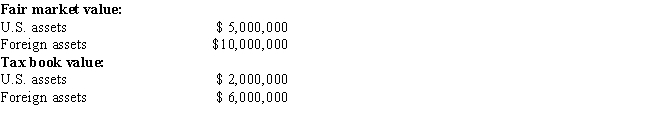

Qwan,a U.S.corporation,reports $250,000 interest expense for the tax year.None of the interest relates to nonrecourse debt or loans from affiliated corporations.Qwan's U.S.and foreign assets are reported as follows.

How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

A) Using tax book values.

B) Using tax book value for U.S. source and fair market value for foreign source.

C) Using fair market values.

D) Using fair market value for U.S. source and tax book value for foreign source.

Correct Answer:

Verified

Q21: U.S. income tax treaties typically:

A) Provide for

Q28: The U.S. system for taxing income earned

Q30: Without the foreign tax credit, double taxation

Q46: ForCo, a foreign corporation, receives interest income

Q47: Which of the following statements is false

Q51: An advance pricing agreement (APA) is used

Q56: Generally, accrued foreign income taxes are translated

Q57: During the current year,USACo (a domestic corporation)

Q58: USCo,a U.S.corporation,purchases inventory from distributors within the

Q60: Wood, a U.S. corporation, owns Holz, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents