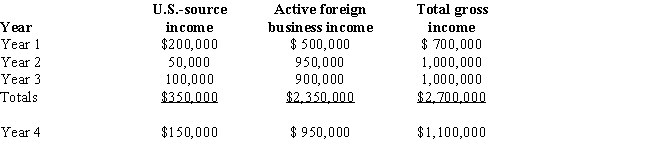

During Year 4,Josita,an NRA,receives interest income of $50,000 from Talmadge,Inc.,an unrelated U.S.corporation.Considering the following facts related to Talmadge's operations,what is the source of the interest income received by Josita?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Match the definition with the correct term.

-Bilateral

Q95: Match the definition with the correct term.

-U.S.

Q109: Match the definition with the correct term.

-Foreign

Q110: USCo, a U.S. corporation, reports worldwide taxable

Q121: In international corporate income taxation, what are

Q124: Describe and diagram the timeline that most

Q126: Discuss the primary purposes of income tax

Q129: USCo,a U.S.corporation,reports worldwide taxable income of $1,500,000,including

Q131: Given the following information,determine whether Greta,an alien,is

Q135: Present,Inc.,a U.S.corporation,owns 60% of the stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents