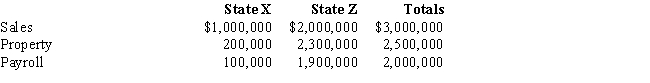

Chipper Corporation realized $1,000,000 taxable income from the sales of its products in States X and Z.Chipper's activities establish nexus for income tax purposes only in Z,the state of its incorporation.Chipper's sales,payroll,and property among the states include the following.

X utilizes a sales-only factor in its three-factor apportionment formula.How much of Chipper's taxable income is apportioned to X?

A) $0

B) $333,333

C) $500,000

D) $1,000,000

Correct Answer:

Verified

Q63: In the income tax apportionment formula, market-sourcing

Q63: General Corporation is taxable in a number

Q65: Britta Corporation's entire operations are located in

Q67: Boot Corporation is subject to income tax

Q67: Generally, a taxpayer's business income is:

A) Apportioned.

B)

Q71: Cruz Corporation owns manufacturing facilities in States

Q72: Generally, nonapportionable income includes:

A) Sales of products

Q72: Helene Corporation owns manufacturing facilities in States

Q73: Marquardt Corporation realized $900,000 taxable income from

Q79: General Corporation is taxable in a number

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents