Simpkin Corporation owns manufacturing facilities in States A,B,and C.A uses a three-factor apportionment formula under which the sales,property and payroll factors are equally weighted.B uses a three-factor apportionment formula under which sales are double-weighted.C employs a single-factor apportionment factor,based solely on sales.

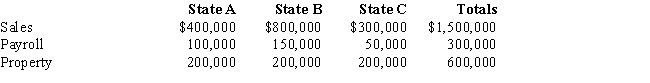

Simpkin's operations generated $1,000,000 of apportionable income,and its sales and payroll activity and average property owned in each of the three states is as follows.

Simpkin's apportionable income assigned to B is:

A) $1,000,000.

B) $533,333.

C) $475,000.

D) $0.

Correct Answer:

Verified

Q51: The most commonly used state income tax

Q53: Public Law 86-272:

A) Was written by the

Q75: Typically,state taxable income includes:

A)Apportionable income only.

B)Nonapportionable income

Q76: In applying the typical apportionment formula:

A) The

Q79: José Corporation realized $900,000 taxable income from

Q81: Trayne Corporation's sales office and manufacturing plant

Q82: In the broadest application of the unitary

Q83: A taxpayer wishing to reduce the negative

Q85: Application of the unitary principle generally works

Q87: A state sales tax usually falls upon:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents