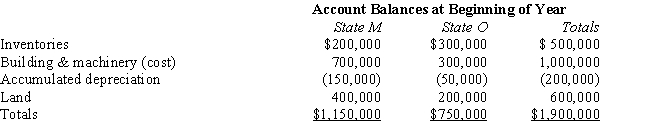

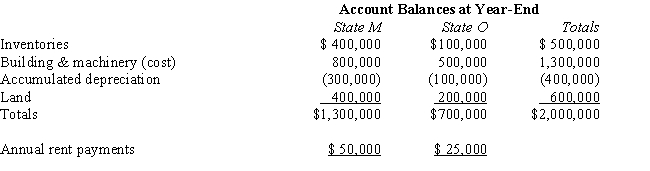

Bert Corporation,a calendar-year taxpayer,owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost,and O requires that the property be included in the property factor at its net depreciated book value.

Bert's State M property factor is:

A) 75.0%.

B) 66.7%.

C) 64.9%.

D) 64.5%.

Correct Answer:

Verified

Q62: The throwback rule requires that:

A) Sales of

Q94: Valdez Corporation,a calendar-year taxpayer,owns property in States

Q95: In most states, a limited liability company

Q99: Ting,a regional sales manager,works from her office

Q99: A use tax applies when a State

Q102: Under Public Law 86-272, a state is

Q108: When the taxpayer operates in one or

Q110: P.L. 86-272_ (does/does not) create nexus when

Q111: The benefits of a passive investment company

Q118: Parent and Minor form a non-unitary group

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents