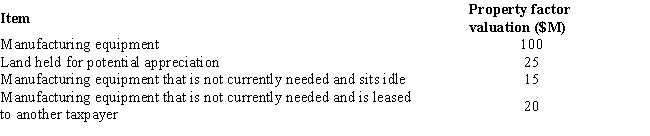

Hopper Corporation's property holdings in State E are as follows.

Compute the numerator of Hopper's E property factor.

A) $100 million.

B) $135 million.

C) $140 million.

D) $160 million.

Correct Answer:

Verified

Q87: For most taxpayers, which of the traditional

Q99: In determining taxable income for state income

Q101: In some states, an S corporation must

Q105: Although apportionment formulas vary among jurisdictions, most

Q106: Apportionment is a means by which a

Q110: State Q has adopted sales-factor-only apportionment for

Q120: In the apportionment formula, most states assign

Q120: Allocation is a method under which a

Q122: Compute Still Corporation's State Q taxable income

Q128: Leased property, when included in the property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents