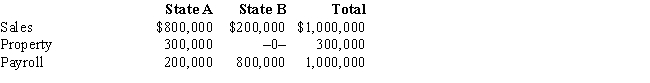

Condor Corporation generated $450,000 of state taxable income from selling its product in States A and B.For the taxable year,the corporation's activities within the two states were as follows.

Condor has determined that it is subject to tax in both A and B.Both states utilize a three-factor apportionment formula that equally weights sales,property,and payroll.The rates of corporate income tax imposed in A and B are 5% and 3%,respectively.Determine Condor's state income tax liability.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Pail Corporation is a merchandiser.It purchases overstock

Q144: Milt Corporation owns and operates two facilities

Q145: Dott Corporation generated $300,000 of state taxable

Q147: Troy,an S corporation,is subject to tax only

Q151: Determine Drieser's sales factors for States K,M,and

Q173: What is the significance of the term

Q176: Anders, a local business, wants your help

Q181: Franz Corporation is based in State A

Q189: State Q wants to increase its income

Q200: Discuss how a multistate business divides up

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents