Determine Drieser's sales factors for States K,M,and N.

Drieser Corporation's manufacturing facility,distribution center,and retail store are located in State K.Drieser sells its products to residents located in States K,M,and N.

Sales to residents of K are conducted through a retail store.Sales to residents of M are obtained by Drieser's sales representative,who has the authority to solicit,accept,and approve sales orders in State M.Residents of N can purchase Drieser's product only if they place an order online and arrange to take delivery of the product at Drieser's shipping dock.

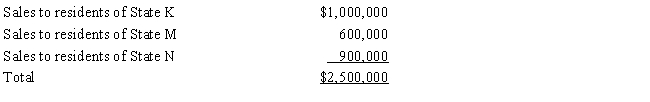

Drieser's sales this year were reported as follows.

Drieser's activities within the three states are limited to those described above.All of the states have adopted a throwback provision and utilize a three-factor apportionment formula under which sales,property,and payroll are equally weighted.State K sources dock sales to the destination state.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q146: Condor Corporation generated $450,000 of state taxable

Q147: Troy,an S corporation,is subject to tax only

Q153: Kim Corporation,a calendar year taxpayer,has manufacturing facilities

Q154: Hambone Corporation is subject to the State

Q156: Flip Corporation operates in two states,as indicated

Q164: Compost Corporation has finished its computation of

Q172: In international taxation, we discuss income sourcing

Q181: Franz Corporation is based in State A

Q189: State Q wants to increase its income

Q200: Discuss how a multistate business divides up

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents