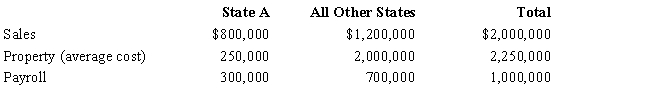

You are completing the State A income tax return for Quaint Company,LLC.Quaint operates in various states,showing the following results.

In A,all interest is treated as apportionable income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: Match each of the following items with

Q139: Match each of the following items with

Q148: Match each of the following terms with

Q156: Flip Corporation operates in two states,as indicated

Q157: Mercy Corporation,headquartered in State F,sells wireless computer

Q159: Garcia Corporation is subject to tax in

Q164: Compost Corporation has finished its computation of

Q181: You are preparing to make a presentation

Q191: Your supervisor has shifted your responsibilities from

Q202: The sales/use tax that is employed by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents