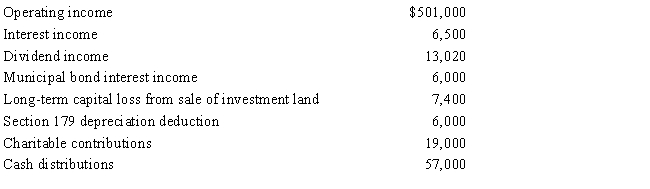

Amit,Inc.,an S corporation,holds an AAA balance of $614,000 at the beginning of the tax year.During the year,the following items occur.

Amit's ending AAA balance is:

A) $1,055,620.

B) $1,185,150.

C) $1,191,150.

D) $1,242,150.

E) Some other amount.

Correct Answer:

Verified

Q55: Which statement is incorrect?

A) S corporations are

Q57: An S corporation is subject to the

Q58: Which, if any, of the following can

Q66: The maximum number of actual shareholders in

Q69: Which, if any, of the following items

Q77: Identify a disadvantage of being an S

Q82: Samantha owned 1,000 shares in Evita,Inc.,an S

Q84: On January 2,2016,David loans his S corporation

Q85: Oxen Corporation incurs the following transactions.

Q86: You are given the following facts about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents