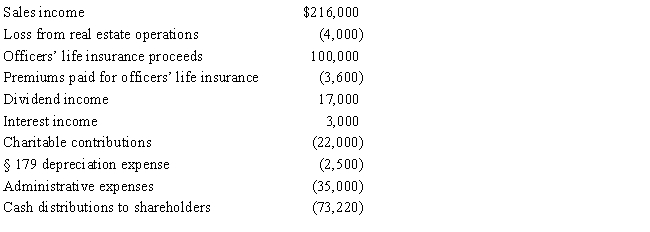

Towne,Inc.,a calendar year S corporation,holds AAA of $627,050 at the beginning of the tax year.During the year,the following items occur.

Calculate Towne's ending AAA balance.

Correct Answer:

Verified

Q88: An S corporation is limited to a

Q103: Stock basis first is increased by income

Q113: Discuss two ways that an S election

Q115: In the case of a complete termination

Q119: Depreciation recapture income is a _ computed

Q121: Explain the OAA concept.

Q122: Compare the distribution of property rules for

Q125: Realized gain is recognized by an S

Q126: Since loss property receives a _ in

Q129: Bidden,Inc.,a calendar year S corporation,incurred the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents