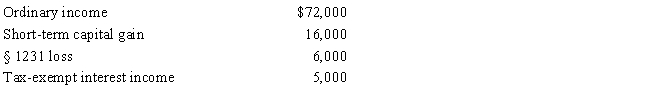

Gene Grams is a 45% owner of a calendar year S corporation during the tax year.His beginning stock basis is $230,000,and the S corporation reports the following items.

Calculate Grams's stock basis at year-end.

Correct Answer:

Verified

Q108: An S corporation's LIFO recapture amount equals

Q115: In the case of a complete termination

Q117: Advise your client how income, expenses, gain,

Q121: Explain the OAA concept.

Q129: Bidden,Inc.,a calendar year S corporation,incurred the following

Q130: Non-separately computed loss _ a S shareholder's

Q134: Alomar,a cash basis S corporation in Orlando,Florida,holds

Q135: You are a 60% owner of an

Q136: Estella,Inc.,a calendar year S corporation,incurred the following

Q137: The § 1202 exclusion of _ on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents