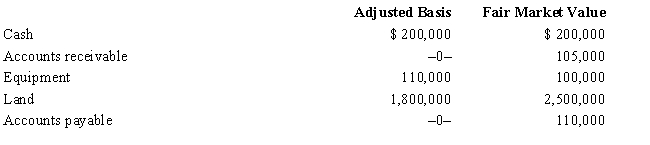

Alomar,a cash basis S corporation in Orlando,Florida,holds the following assets and liabilities on January 1,2016,the date the S election is made.

During the year,Alomar collects the accounts receivable and pays the accounts payable.The land is sold for $3 million,and the taxable income for the year is $590,000.Calculate any built-in gains tax.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q108: An S corporation's LIFO recapture amount equals

Q109: An S corporation recognizes a on any

Q117: Advise your client how income, expenses, gain,

Q129: Bidden,Inc.,a calendar year S corporation,incurred the following

Q130: Non-separately computed loss _ a S shareholder's

Q132: Gene Grams is a 45% owner of

Q135: You are a 60% owner of an

Q136: Estella,Inc.,a calendar year S corporation,incurred the following

Q137: The § 1202 exclusion of _ on

Q138: Pepper,Inc.,an S corporation in Norfolk,Virginia,has revenues of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents