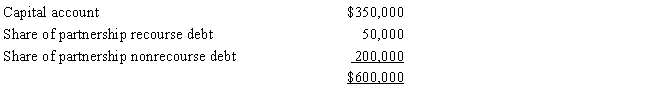

The MOP Partnership is involved in construction activities.Patricia has an adjusted basis for her partnership interest on January 1 of the current year of $600,000,consisting of the following.

During the year,the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia.Partnership liabilities were the same at the end of the tax year,and the nonrecourse debt is not "qualified nonrecourse debt." If she owns a 60% share of partnership profits,capital,and losses,and is an active ("material") participant in the partnership,how much of her share of the operating loss can Patricia deduct? What Code provisions could cause a suspension of the loss? How would your answer change if MOP were an LLC and Patricia had not personally guaranteed any of the debt?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Cassandra is a 10% limited partner in

Q136: Morgan is a 50% managing member in

Q138: Match each of the following statements with

Q166: Match each of the following statements with

Q167: Match each of the following statements with

Q170: Jeordie and Kendis created the JK Partnership

Q174: Match each of the following statements with

Q222: Harry and Sally are considering forming a

Q225: Your client owns a parcel of land

Q228: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents