Cedar Corporation is a calendar year taxpayer formed in 2013.Cedar's E & P before distributions for each of the past 5 years is listed below.

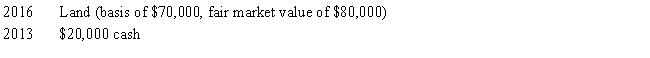

Cedar Corporation made the following distributions in the previous 5 years.

Cedar's accumulated E & P as of January 1,2018 is:

A) $91,000.

B) $95,000.

C) $101,000.

D) $105,000.

E) None of the above.

Correct Answer:

Verified

Q45: The tax treatment of corporate distributions at

Q61: Renee, the sole shareholder of Indigo Corporation,

Q68: Maria and Christopher each own 50% of

Q75: Tangelo Corporation has an August 31 year-end.Tangelo

Q78: Glenda is the sole shareholder of Condor

Q79: Tern Corporation, a cash basis taxpayer, has

Q79: Stacey and Andrew each own one-half of

Q81: In the current year,Warbler Corporation (E &

Q82: At the beginning of the current year,Doug

Q94: On January 1, Eagle Corporation (a calendar

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents