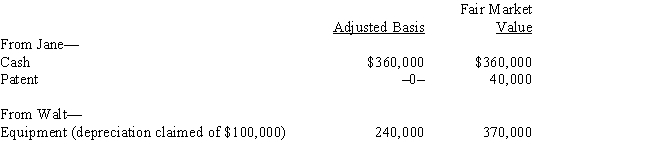

Four individuals form Chickadee Corporation under § 351.Two of these individuals,Jane and Walt,made the following contributions:

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of the above.

Correct Answer:

Verified

Q61: George transfers cash of $150,000 to Finch

Q63: Dawn, a sole proprietor, was engaged in

Q68: Earl and Mary form Crow Corporation. Earl

Q70: Carl transfers land to Cardinal Corporation for

Q79: Adam transfers cash of $300,000 and land

Q91: Rita forms Finch Corporation by transferring land

Q91: Art, an unmarried individual, transfers property (basis

Q94: Ashley, a 70% shareholder of Wren Corporation,

Q99: Wren Corporation (a minority shareholder in Lark

Q100: Nick exchanges property (basis of $100,000; fair

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents