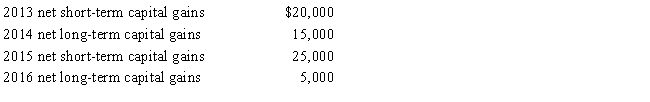

Ostrich,a C corporation,has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2017.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

a.How are the capital gains and losses treated on Ostrich's 2017 tax return?

b.Determine the amount of the 2017 net capital loss that is carried back to each of the previous years.

c.Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d.If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2017 tax return?

Correct Answer:

Verified

Q61: What is a limited liability company? What

Q64: Dawn is the sole shareholder of Thrush

Q69: Schedule M-1 of Form 1120 is used

Q96: Tonya,an actuary,is the sole shareholder of Shrike

Q97: Robin Corporation,a calendar year C corporation,had taxable

Q99: On December 28,2017,the board of directors of

Q121: Adrian is the president and sole shareholder

Q126: Briefly describe the charitable contribution deduction rules

Q127: Contrast the tax treatment of capital gains

Q137: In connection with the deduction for startup

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents