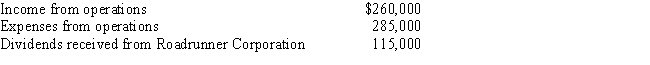

During the current year,Coyote Corporation (a calendar year C corporation) has the following transactions:

a.Coyote owns 5% of Roadrunner Corporation's stock. How much is Coyote Corporation's taxable income (loss) for the year?

b.Would your answer change if Coyote owned 25% of Roadrunner Corporation's stock?

Correct Answer:

Verified

Q80: Copper Corporation owns stock in Bronze Corporation

Q81: During the current year,Skylark Company had operating

Q82: Almond Corporation,a calendar year C corporation,had taxable

Q83: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q84: During the current year,Maroon Company had $125,000

Q86: In each of the following independent situations,determine

Q87: Amber Company has $100,000 in net income

Q88: A taxpayer is considering the formation of

Q89: Warbler Corporation,an accrual method regular corporation,was formed

Q90: Compare the basic tax and nontax factors

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents