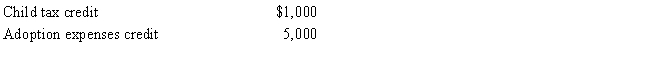

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000.and his tentative minimum tax is $195,000.Justin reports the following credits.

Calculate Justin's tax liability after credits.

A) $190,000

B) $194,000

C) $195,000

D) $200,000

Correct Answer:

Verified

Q58: Prior to the effect of tax credits,

Q63: For regular income tax purposes, Yolanda, who

Q73: In 2017, Blake incurs $270,000 of mining

Q74: Vinny's AGI is $250,000. He contributed $200,000

Q77: Marvin, the vice president of Lavender, Inc.,

Q79: Which of the following itemized deductions are

Q80: Mitch,who is single and age 46 and

Q82: Bianca and David report the following for

Q88: Celia and Christian, who are married filing

Q99: In 2017, Liam's filing status is married

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents