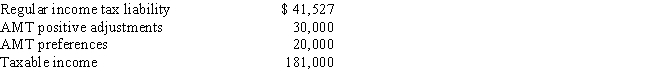

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2017.Robert itemizes deductions.

Calculate Robin's AMT for 2017.

A) $6,633.

B) $13,332.

C) $48,828.

D) $54,428.

Correct Answer:

Verified

Q68: Tamara operates a natural gas sole proprietorship

Q81: Which of the following regular taxable income

Q82: Bianca and David report the following for

Q83: Mauve,Inc.,records the following gross receipts in 2015,2016,and

Q85: Caroline and Clint are married,have no dependents,and

Q88: Use the following selected data to calculate

Q89: Arlene,who is single,reports taxable income for 2017

Q91: Use the following data to calculate Jolene's

Q93: In 2017, Brenda has calculated her regular

Q111: Which of the following would not cause

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents