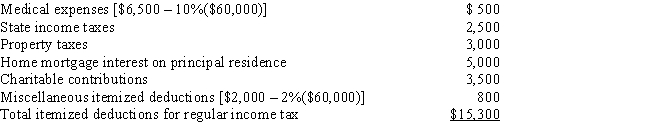

In calculating her 2017 taxable income,Rhonda,who is age 45,claims the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Do AMT adjustments and AMT preferences increase

Q87: How can an AMT adjustment be avoided

Q95: In 2017, Brenda has calculated her regular

Q96: What tax rates apply in calculating the

Q101: Darin,who is age 30,records itemized deductions in

Q101: Lilly is single and reports zero taxable

Q104: Cindy,who is single and age 48,has no

Q104: Why is there a need for a

Q108: Lavender,Inc.,incurs research and experimental expenditures of $210,000

Q112: Frederick sells equipment whose adjusted basis for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents