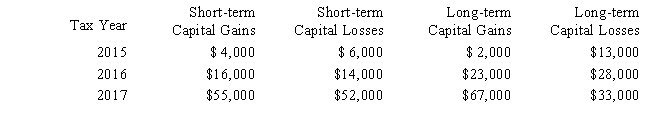

The chart below details Sheen's 2015,2016,and 2017 stock transactions.What is the capital loss carryover to 2017 and what is the net capital gain or loss for 2017?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Carol had the following transactions during 2017:

Q64: Larry was the holder of a patent

Q65: A business machine purchased April 10, 2016,

Q69: Phil's father died on January 10, 2017.

Q78: In early 2016, Wanda paid $33,000 for

Q116: Theresa and Oliver,married filing jointly,and both over

Q121: An individual has the following recognized gains

Q121: An individual taxpayer has the gains and

Q122: Williams owned an office building (but not

Q127: An individual has a $40,000 § 1245

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents