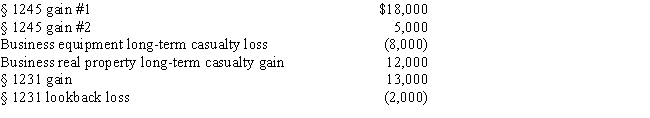

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: A business machine purchased April 10, 2016,

Q69: In 2017 Angela, a single taxpayer with

Q70: Ranja acquires $200,000 face value corporate bonds

Q72: Charmine, a single taxpayer with no dependents,

Q78: In early 2016, Wanda paid $33,000 for

Q121: An individual taxpayer has the gains and

Q122: Williams owned an office building (but not

Q125: The chart below describes the § 1231

Q130: A business taxpayer sold all the depreciable

Q141: "Collectibles" held long-term and sold at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents