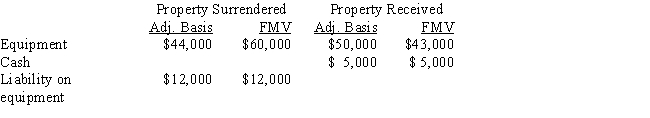

Sammy exchanges equipment used in his business in a like-kind exchange.The property exchanged is as follows:

The other party assumes the liability.

a.What is Sammy's recognized gain or loss?

b.What is Sammy's basis for the assets he received?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Jake exchanges an airplane used in his

Q92: Chaney exchanges a truck used in her

Q101: Mandy and Greta form Tan, Inc., by

Q112: On January 5, 2017, Waldo sells his

Q114: Carlos, who is single, sells his personal

Q115: Evelyn's office building is destroyed by fire

Q224: What requirements must be satisfied for a

Q242: Discuss the treatment of losses from involuntary

Q250: Under what circumstances may a partial §

Q276: Louis owns a condominium in New Orleans

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents