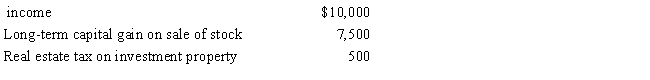

Barb borrowed $100,000 to acquire a parcel of land to be held for investment purposes and paid interest of $11,000 on the loan.She has AGI of $75,000 for the year.Other items related to Barb's investments include the following:

Interest and annuity

a.Determine Barb's current investment interest deduction, assuming she does not make any special election regarding the computation of investment income.

b.Discuss the treatment of Barb's investment interest that is disallowed in the current year.

c.What election could Barb make to increase the amount of her current investment interest deduction?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Sandra acquired a passive activity three years

Q80: Rita earns a salary of $150,000, and

Q84: Kate dies owning a passive activity with

Q95: In 2016, Kelly earns a salary of

Q101: Purple Corporation, a personal service corporation, earns

Q114: Vail owns interests in a beauty salon,

Q115: Anne sells a rental house for $100,000

Q122: Last year, Wanda gave her daughter a

Q123: Identify how the passive activity loss rules

Q128: When a taxpayer disposes of a passive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents