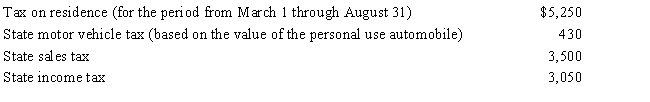

Nancy paid the following taxes during the year:

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller.What amount qualifies as a deduction from AGI for Nancy?

A) $9,180

B) $9,130

C) $7,382

D) $5,382

E) None of the above

Correct Answer:

Verified

Q41: Ronaldo contributed stock worth $12,000 to the

Q49: During the year, Victor spent $300 on

Q59: Al contributed a painting to the Metropolitan

Q60: Charitable contributions that exceed the percentage limitations

Q63: Tom,age 48,is advised by his family physician

Q65: Karen,a calendar year taxpayer,made the following donations

Q67: Pedro's child attends a school operated by

Q67: Hannah makes the following charitable donations in

Q72: In 2017, Boris pays a $3,800 premium

Q75: Your friend Scotty informs you that he

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents