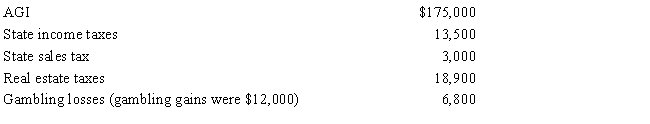

Paul,a calendar year married taxpayer,files a joint return for 2017.Information for 2017 includes the following:

Paul's allowable itemized deductions for 2017 are:

A) $13,500.

B) $32,400.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Q82: Brian, a self-employed individual, pays state income

Q86: Samuel, a 36-year-old individual who has been

Q86: During 2017, Kathy, who is self-employed, paid

Q89: Diane contributed a parcel of land to

Q90: Linda, who has AGI of $120,000 in

Q90: Linda is planning to buy Vicki's home.They

Q92: Pat gave 5,000 shares of stock in

Q96: For the past several years, Jeanne and

Q100: Marilyn,age 38,is employed as an architect.For calendar

Q106: Joe, who is in the 33% tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents