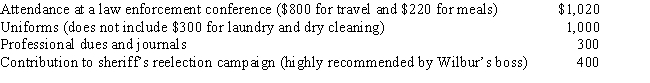

For the current year,Wilbur is employed as a deputy sheriff of a county.He has AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Myra's classification of those who work for

Q110: Rod uses his automobile for both business

Q112: Meredith holds two jobs and attends graduate

Q112: If a business retains someone to provide

Q115: Elsie lives and works in Detroit. She

Q116: Rocky has a full-time job as an

Q118: Cathy takes five key clients to a

Q120: Brian makes gifts as follows:

Q125: In terms of income tax treatment, what

Q137: Taylor performs services for Jonathan on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents