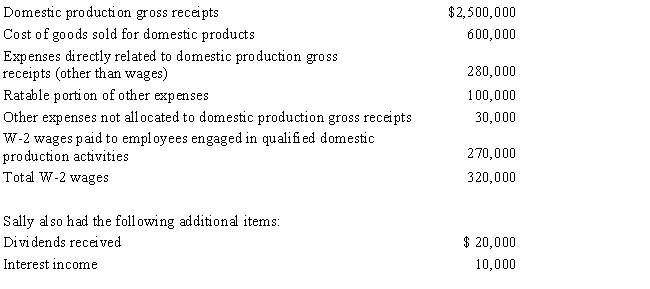

Red Company is a proprietorship owned by Sally,a single individual.Red manufactures and sells widgets.An examination of Red's records shows the following items for the current year:

Determine Sally's domestic production activities deduction for the current year.

Correct Answer:

Verified

Q85: While Susan was on vacation during the

Q92: In 2017,Tan Corporation incurred the following expenditures

Q94: Gary,who is an employee of Red Corporation,has

Q102: How is qualified production activities income (QPAI)

Q103: Roger, an individual, owns a proprietorship called

Q104: What are the three methods of handling

Q107: Discuss the tax treatment of nonreimbursed losses

Q109: Identify the factors that should be considered

Q113: Discuss the treatment, including the carryback and

Q120: Susan has the following items for 2017:

∙

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents