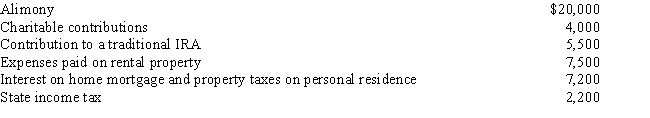

Al is single,age 60,and has gross income of $140,000.His deductible expenses are as follows:

What is Al's AGI?

A) $94,100.

B) $103,000.

C) $107,000.

D) $127,000.

E) None of the above.

Correct Answer:

Verified

Q39: Jacques, who is not a U.S.citizen, makes

Q45: Martha rents part of her personal residence

Q46: If a vacation home is classified as

Q47: If a vacation home is classified as

Q48: Sammy,a calendar year cash basis taxpayer who

Q52: Hobby activity expenses are deductible from AGI

Q53: A vacation home at the beach which

Q54: LD Partnership, a cash basis taxpayer, purchases

Q56: Purchased goodwill must be capitalized but can

Q57: The portion of property tax on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents