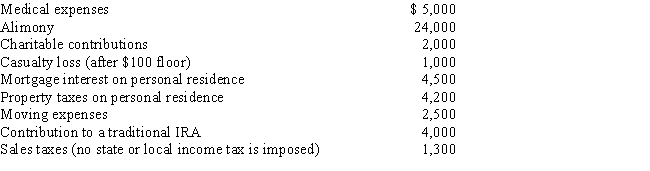

Austin,a single individual with a salary of $100,000,incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Tommy, an automobile mechanic employed by an

Q78: Tom operates an illegal drug-running operation and

Q79: Terry and Jim are both involved in

Q82: Sandra owns an insurance agency.The following selected

Q85: Bob and April own a house at

Q88: Robyn rents her beach house for 60

Q91: On January 2, 2017, Fran acquires a

Q94: Alfred's Enterprises, an unincorporated entity, pays employee

Q100: Robin and Jeff own an unincorporated hardware

Q109: Petula's business sells heat pumps which have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents