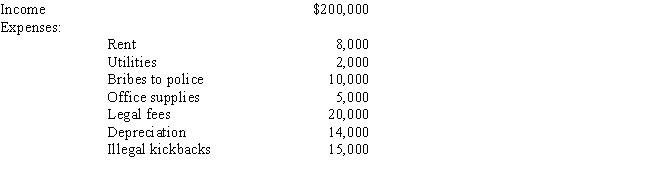

Kitty runs a brothel (illegal under state law) and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: In January, Lance sold stock with a

Q84: Beige, Inc., an airline manufacturer, is conducting

Q88: Robyn rents her beach house for 60

Q90: Albie operates an illegal drug-running business and

Q91: Cory incurred and paid the following expenses:

Q95: Arnold and Beth file a joint return.Use

Q97: Which of the following is not deductible?

A)Moving

Q98: Melba incurred the following expenses for her

Q101: Taylor, a cash basis architect, rents the

Q116: In order to protect against rent increases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents