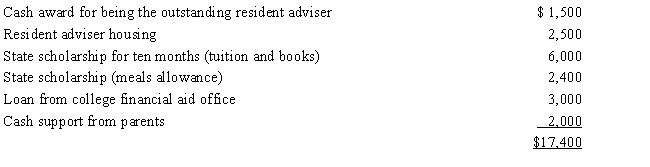

Ron,age 19,is a full-time graduate student at City University.During 2017,he received the following payments:

Ron served as a resident adviser in a dormitory and,therefore,the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2017?

A) $1,500.

B) $3,900.

C) $9,000.

D) $15,400.

E) None of these.

Correct Answer:

Verified

Q46: The exclusion for health insurance premiums paid

Q49: Jack received a court award in a

Q50: Ben was diagnosed with a terminal illness.His

Q52: As an executive of Cherry, Inc., Ollie

Q53: Swan Finance Company, an accrual method taxpayer,

Q54: Christie sued her former employer for a

Q54: During the current year, Khalid was in

Q55: Julie was suffering from a viral infection

Q58: The taxpayer is a Ph.D.student in accounting

Q58: Albert had a terminal illness which required

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents