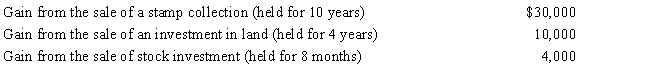

Perry is in the 33% tax bracket.During 2017,he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

A) (15% × $30,000) + (33% × $4,000) .

B) (15% × $10,000) + (28% × $30,000) + (33% × $4,000) .

C) (0% × $10,000) + (28% × $30,000) + (33% × $4,000) .

D) (15% × $40,000) + (33% × $4,000) .

E) None of these.

Correct Answer:

Verified

Q92: In which, if any, of the following

Q104: During 2017,Trevor has the following capital transactions:

After

Q106: Kirby is in the 15% tax bracket

Q109: During 2017,Addison has the following gains and

Q110: Pedro is married to Consuela, who lives

Q110: Edgar had the following transactions for 2017:

What

Q111: In 2017, Ashley earns a salary of

Q111: Taylor had the following transactions for 2017:

What

Q112: For the current year,David has wages of

Q113: Meg, age 23, is a full-time law

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents