Use this information to answer questions 13-15.

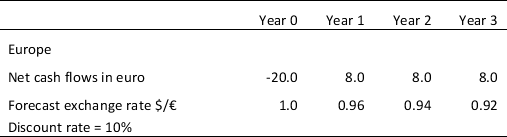

Big Can, Inc., a U.S. firm, manufactures and sells aluminum cans worldwide. Because of a rising price of aluminum in the U.S., the company is considering to build a new plant in Europe. The plant will cost €20 million to build. Assume that the plant will have a life of 3 years before it is confiscated by the European government zero salvage value and the discount rate of the cash flows is 10%. Consider the following cash flows for this project.

Table 9.2

-Refer to Table 9.2.The net present value NPV of this project in U.S.dollar is estimated at:

A) - $0.11million

B) - $1.27 million

C) $2.33 million

D) $1.14 million

Correct Answer:

Verified

Q15: A documentary credit is issued to importer

Q16: Which of the following is NOT a

Q17: The goal of a multinational corporation MNC

Q18: Comparing with information in Table 9.1,if the

Q19: After considering the long-term implications of the

Q21: Which of the following are advantages of

Q22: Capital budgeting refers to the evaluation of

Q23: For a multinational firm using a decentralized

Q24: When a multinational firm calculates a project

Q25: If multinational businesses want managers of foreign

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents