Assume two countries,A and B have the following Fisher equations,where i is nominal interest rate,r is real interest rate,and π is the expected rate of inflation:

iA = rA + πA

iB = rB + πB

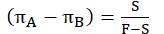

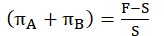

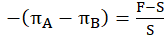

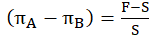

Spot and forward rates are expressed as currency A per currency B.When the covered interest parity holds and rA = rB, then

A)

B)

C)

D)

Correct Answer:

Verified

Q15: Use the following information to answer questions

Q16: Use the following information to answer questions

Q17: Use the following information to answer questions

Q18: Suppose that the one-year U.S.interest rate is

Q19: Assume the following:

You have $10,000 to invest.

The

Q21: Use the following graph to answer questions

Q22: When investors hedge themselves from risk using

Q23: If the expected inflation in Brazil in

Q24: Assume a nominal interest rate on one-year

Q25: Which of the following reasons explain why

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents