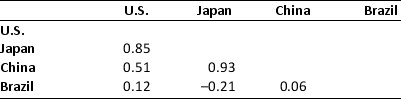

Based on this table of correlation coefficients of real dollar returns of assets in different countries,which two countries appear to provide the greatest amount of benefit from diversification?

A) The U.S. and Japan

B) China and Japan

C) Japan and Brazil

D) China and Brazil

Correct Answer:

Verified

Q2: A portfolio manager has decided to invest

Q2: Security A and Security B have a

Q3: Capital market segmentation is a financial market

Q4: Which of the following statements is TRUE?

I.Diversification

Q5: ADR is:

A) a type of Eurodollar loans.

B)

Q7: Assume that the expected returns of the

Q8: Which of the following would not be

Q9: Company specific risk is also known as:

A)

Q10: Assume that the expected returns of the

Q11: When a country moves from segmented capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents