Use the following information for 14-15.

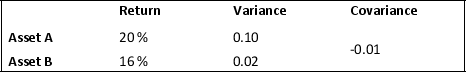

Assume that you have a choice of two assets, A and B, and a portfolio of an equal share of the two assets. Assume also that the assets have the following statistics:

Table 10.1:

-See Table 10.1.The negative covariance between Asset A and Asset B means that when returns on Asset A decrease then,

A) The variance of Asset B tends to decreases

B) The returns on Asset B tend to decrease

C) The returns on Asset B tend to increase

D) The variance on Asset A tends to decreases

Correct Answer:

Verified

Q31: The risk present in all investment opportunities

Q39: Investors often hold _ to reduce risk

Q40: ADRs are used by domestic investors because

Q42: A stock market in which foreign investors

Q43: When the covariance of two assets is

Q45: A globalized market is a stock market

Q46: The smaller the variance of variability of

Q47: Consider the following variances of different stocks

Q48: When the _ of two assets is

Q49: The weighted average of the returns on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents