Use the following information to answer questions 24-25.

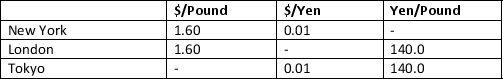

Assume that the following exchange rates exist for the U.S. dollar, Japanese Yen and the British Pound.

-If you are an arbitrageur that starts with $1,000 in New York,

A) You will buy pound in New York, because pound is cheaper in New York.

B) You will buy yen in New York, because pound is more expensive in New York.

C) You will buy both pound and yen in New York to spread the risk.

D) There is no arbitrage opportunity in this case.

Correct Answer:

Verified

Q11: The exchange rate is

A)the price of one

Q24: If the price of British pounds in

Q25: Assume that the dollar value of a

Q26: When the value of the dollar changes

Q27: Assume that the dollar value of a

Q29: Use the following information to answer questions

Q30: In foreign exchange trading,arbitrage has _ risk

Q31: Today 1 euro can be purchased for

Q32: One dollar is worth ¥80,and one Thai

Q33: Suppose that Bank of America quotes you

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents