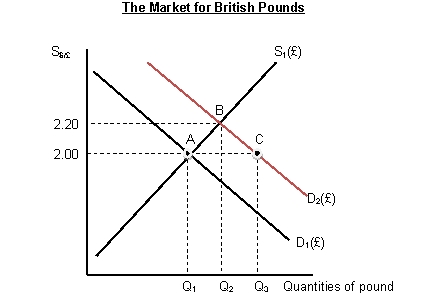

Use the graph below to answer questions 9 - 12.

Figure 1.1

-Refer to Figure 1.1.Suppose that the market for British pound is initially in equilibrium at point A with the exchange rate $2.00 per pound.Then the demand curve shifts to D2.If the British central bank wants to fix the exchange rate at $2.00/pound,they have to:

A) buy pound and sell dollar by the amount of Q3 - Q1.

B) sell pound and buy dollar by the amount of Q3 - Q1.

C) sell only pound by the amount of Q3 - Q1 and leave dollar alone.

D) buy only pound by the amount of Q3 - Q1 and leave dollar alone.

Correct Answer:

Verified

Q58: A trader at a U.S.bank believes that

Q59: Suppose that the current buy rate for

Q60: Exchange rates are 150 yen per dollar,0.8

Q61: Bid price is the price at which

Q62: If the Japanese yen was worth $.005

Q64: Use the graph below to answer questions

Q65: Use the following information to answer questions

Q66: Use the graph below to answer questions

Q67: The Citibank trading desk quotes a buy

Q68: Assume that the exchange rate is currently

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents