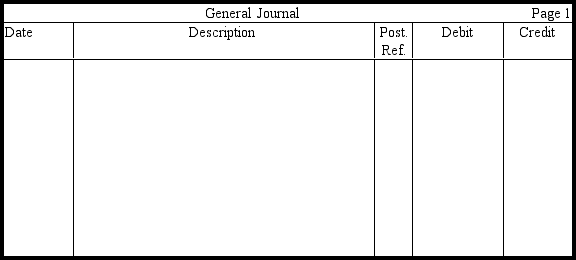

Kagel Corporation computed its actual income taxes payable for 20xx to be $92,000.Because of differences in accounting procedures and income tax rules,the income taxes expense to be reported for 20xx is $107,000.Prepare the entry in journal form without explanation to record the income taxes expense and income taxes payable for 20xx.

Correct Answer:

Verified

Q139: On July 1,20xx,Tobias Corporation had 20,000 shares

Q141: How do the accounting conventions of full

Q143: Specifically, what gives rise to the Deferred

Q144: The preparation of a statement of stockholders'

Q146: Indicate on the blanks below the effect

Q151: Which of the following would not affect

Q153: Distinguish between cash and retained earnings.

Q155: Ricardo Corporation reported earnings per share of

Q156: If only common stock is outstanding,total stockholders'

Q156: Define the term quality of earnings, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents