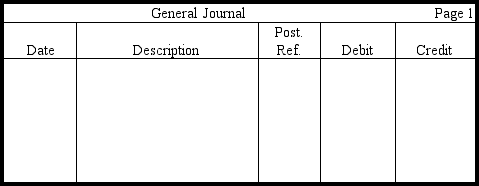

On January 1,20xx,Hilary Corporation acquired 100 percent of the common stock of Gooden Corporation for $3,250,000.At the date of acquisition,Gooden Corporation reported total assets of $4,200,000,liabilities of $1,200,000,common stock of $2,200,000,and retained earnings of $800,000 on its balance sheet.An appraisal on the acquisition date showed that the fair value of Gooden's net identifiable assets was equal to their book value.Prepare the eliminating entry in journal form that would appear on the work sheet for consolidating the balance sheets of the two companies as of the acquisition date.(Omit explanations.)

Correct Answer:

Verified

Q155: Knabe Corporation purchased 3,000 shares of Duncan

Q156: In the journal provided,prepare the entries

Q157: On January 1,2009,Grant Corporation acquired 90 percent

Q158: McDuff Company owns 100 percent of

Q159: At the beginning of the current year,Morris

Q161: Rosche Company purchased 75 percent of Grubbs

Q162: Burr Company purchased 70 percent of Oswald

Q163: Sugar Company owns 100 percent of the

Q164: At December 31, 2010, the book value

Q165: Match each item to the effect of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents