Under what circumstances should compensation expense be recorded for a stock option plan?

5.Berman Corporation was organized during 20xx.In organizing,the company incurred the following costs:

1.Paid the state $900 for the corporate charter and related fees of incorporation.

2.Paid the attorney $2,500 for services rendered in connection with filing incorporation papers with the state.

3.Issued 500 shares of $5 par value common stock to an accountant in exchange for accounting services valued at $3,000.

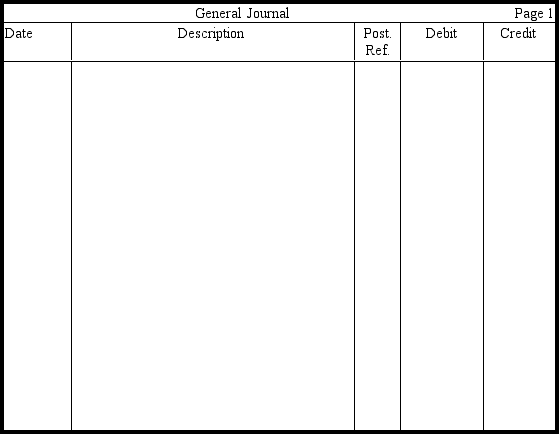

Prepare the entries in journal form necessary to record the above transactions without explanations.

Correct Answer:

Verified

Q127: The purchase of treasury stock will result

Q128: According to generally accepted accounting principles,treasury stock

Q129: On the balance sheet,treasury stock owned by

Q143: Indicate on the blanks below the net

Q149: If the entry to record the retirement

Q152: Use the following information to answer

Q158: On June 1,2008,Will Oldman,treasurer of A-One Corporation,received

Q160: The following information relates to the

Q183: Why must a corporation have sufficient retained

Q194: Margil Industries has 40,000 shares of 9

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents