McPherson Corporation has $1,000,000 of 20-year,9 percent bonds dated October 1,with interest payment dates of September 30 and March 31.The company's fiscal year ends July 31,and it uses the effective interest method to amortize premium or discount.

a. Prepare entries in journal form for November 1, March 31, and July 31, assuming that the bonds were issued at face value plus accrued interest on November 1. Round answers to the nearest dollar and omit explanations.

b. Prepare entries in journal form for October 1, March 31, and July 31, assuming that the bonds were issued at 98 on October 1 to yield an effective interest rate of 9.2 percent. Round answers to the nearest dollar and omit explanations.

Correct Answer:

Verified

Q182: Comment on the change in both the

Q190: Technically,what is meant by the amortization of

Q191: When determining the value of a bond

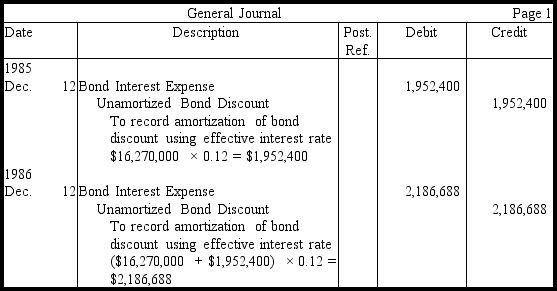

Q193: On January 1,2010,Woodvale Corporation issued five-year term

Q194: On January 1,20xx,Lurline Corporation issued ten-year,8 percent

Q198: On November 1,2009,Fields Corporation issued $800,000 worth

Q199: On January 2,20xx,Horst Corporation issued ten-year,8 percent

Q201: On December 31,2009,the balance sheet of L

Q202: On March 1,2009,Sklar Corporation issued bonds with

Q203: Match each of the following characteristics as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents