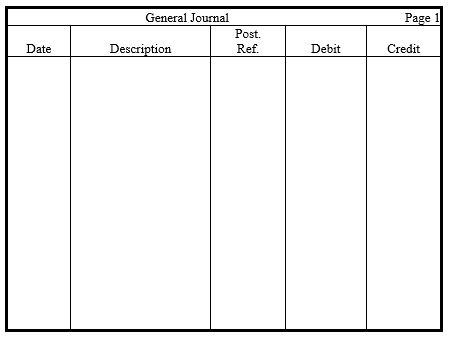

In the journal provided,prepare year-end adjustments for the following situations.Omit explanations.

a. Accrued interest on notes receivable is $105.

b. Of the $12,000 received in advance of earning a service, one-third was still unearned by year end.

c. Three years' rent, totaling $36,000, was paid in advance at the beginning of the year.

d. Services totaling $5,300 had been performed, but not yet billed.

e. Depreciation on trucks totaled $3,400 for the year.

f. Supplies available for use totaled $690. However, by year end, only $100 in supplies remained.

g. Payroll for the five-day work week, to be paid on Friday, is $30,000. Year end falls on a Monday.

h. Estimated federal income taxes were $4,160.

Correct Answer:

Verified

Q148: Why will the Income Summary account never

Q161: Joan Miller owns an advertising agency.One of

Q162: Answer the following questions.(Show your work. )

a.Revenue

Q204: During the performance of the steps in

Q209: Distinguish between adjusting and closing entries.

Q228: The Retained Earnings,Dividends,and Income Summary accounts for

Q232: Below are the adjusted accounts of

Q233: Presented below are the Retained Earnings,Dividends,and Income

Q235: The 20xx income statement for Newton

Q236: Given the adjusted trial balance below,prepare

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents